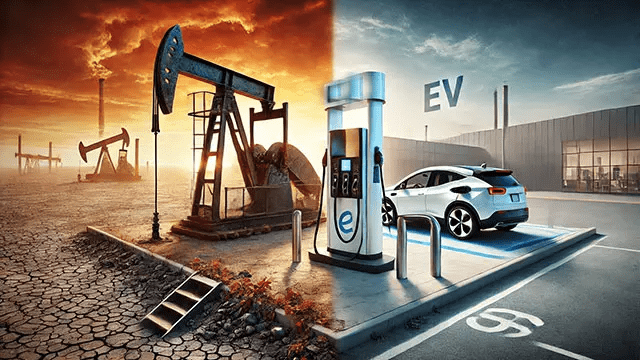

Bearish inventories and demand worries

Oil prices slid to their lowest level in nearly five years, with U.S. crude settling below $57 a barrel. Traders cited a bigger-than-expected stock build, robust U.S. output and softening demand signals from major economies. The drop is easing gasoline and heating costs but squeezing shale producers already contending with tighter credit. Brent also fell, extending a multi-week slump that reflects ample supply and tepid consumption.

Winners, losers and near-term outlook

Consumers and fuel-intensive sectors get relief if the decline holds through winter. Airlines and shippers may lock in lower prices, while petro states face budget pressure and could eye new cuts. Analysts warn an abrupt rebound is still possible if OPEC+ surprises or if geopolitical risks flare in key transit lanes. For now, high inventories and cautious macro sentiment dominate. Utilities and data-center operators watching power costs may see temporary breathing room; energy transition investors will watch whether lower fossil prices slow clean-tech momentum.

TPW DESK

TPW DESK